Crane finance provides businesses with the means to acquire expensive lifting equipment without paying full cost upfront. By leveraging crane equipment financing, companies can maintain cash flow while accessing modern cranes essential for construction and industrial projects. Understanding how to finance a crane is crucial for optimizing budgets and ensuring timely project completion. This approach allows firms to choose between loans, leasing programs, or hire purchase options tailored to their needs. With proper planning, crane finance enables both small and large companies to expand operational capacity efficiently, manage risks, and stay competitive in demanding markets.

What Is Crane Finance

Crane finance is a specialized type of financial solution that allows businesses to acquire expensive lifting equipment without paying full price upfront. Companies often rely on crane financing options and crane equipment financing to maintain cash flow while expanding their operations. This method is crucial for construction companies and industrial operators who need heavy equipment crane loans to handle large projects efficiently. Financing a crane spreads the cost over time and often includes flexible payment plans, which makes it accessible for businesses of different sizes. Whether acquiring a mobile crane or a tower crane, construction crane financing ensures that companies can meet project demands without straining their budgets.

Financial institutions provide tailored solutions, including mobile crane finance, crane leasing programs, and used crane financing, to suit varied operational needs. Firms can select financing based on project length, equipment type, and ownership preferences. New crane financing often comes with lower maintenance risk, while used crane financing offers cost savings. Understanding crane loan rates and consulting multiple crane finance companies helps businesses find the most suitable financial structure.

How Crane Finance Works in the Construction Industry

In the construction sector, crane finance works by offering a structured payment method for expensive cranes. Companies assess their needs and apply for equipment finance for cranes or crane hire purchase agreements, which define repayment schedules and interest terms. Financing provides immediate access to equipment, allowing projects to start on time while avoiding large upfront investments. Lenders evaluate credit history, business health, and project scope to determine financing terms. Crane refinance options may also be available to restructure existing loans, reduce payments, or access additional capital.

Businesses rely on industrial crane funding to maintain competitiveness and meet tight project timelines. Options like crane asset financing and crane capital financing allow firms to preserve liquidity while expanding their operational capacity. Commercial crane loans are often structured with clear repayment plans and sometimes include maintenance packages. Companies compare crane purchase financing and crane leasing vs loan options to balance ownership benefits against costs. By understanding how financing works, firms can optimize cash flow and achieve long-term operational goals.

Why Businesses Choose Crane Financing Instead of Paying Cash

Companies often avoid paying cash because large cranes can cost hundreds of thousands or even millions of dollars. Crane financing options allow businesses to acquire equipment immediately without exhausting capital. By using crane equipment financing or heavy equipment crane loans, firms maintain working capital for other operations such as payroll and project expenses. Financing also provides flexibility, enabling companies to scale operations without financial strain. Choosing construction crane financing ensures that projects are completed efficiently and on schedule while reducing cash flow risks.

Businesses also benefit from mobile crane finance or crane leasing programs, which include upgrades and maintenance options. Used crane financing can make older models more affordable, while new crane financing offers warranties and reliability. Accessing multiple crane loan rates from various crane finance companies allows firms to compare costs and select optimal financing terms. This strategic approach ensures companies gain both financial flexibility and operational capacity simultaneously.

Types of Crane Finance Options Available

Several crane financing options exist to suit different business needs. Companies can choose crane equipment financing for outright ownership or explore heavy equipment crane loans for flexible repayment schedules. Construction crane financing often includes leasing arrangements, enabling firms to use cranes temporarily. Mobile crane finance provides short-term access for project-based requirements, while crane leasing programs offer upgrades and maintenance within the agreement. Used crane financing reduces costs, and new crane financing ensures reliable equipment with warranties.

The table below compares common crane financing types and their advantages:

| Financing Type | Key Benefits | Ideal For |

| Equipment Loan | Full ownership, fixed payments | Long-term projects |

| Lease | Lower upfront cost, maintenance included | Short-term or seasonal work |

| Hire Purchase | Ownership after payments | Small to mid-size firms |

| Refinance | Restructure debt, free up cash | Companies with existing cranes |

Companies also explore industrial crane funding and crane asset financing to secure larger projects while maintaining liquidity. Crane capital financing and commercial crane loans offer flexible terms depending on project scope. Businesses must evaluate crane purchase financing and crane leasing vs loan to select the best approach for operational efficiency.

Crane Loans vs Crane Leasing Explained

Understanding crane loans vs crane lease helps businesses make informed decisions. Loans provide ownership with fixed payments, making crane financing options more suitable for long-term investments. Leasing reduces upfront costs, includes service packages, and allows upgrades, making crane equipment financing convenient for short-term projects. Heavy equipment crane loans may require higher credit scores, while leasing is often more accessible to small firms.

Financial planners advise comparing construction crane financing terms, interest rates, and repayment schedules. Mobile crane finance and crane leasing programs can also include insurance and maintenance. Evaluating used crane financing against new crane financing ensures businesses choose a solution that balances reliability with cost-effectiveness. Crane loan rates and lender reputations influence whether companies opt for loans or leases.

New Crane Financing vs Used Crane Financing

Choosing between new crane financing and used crane financing depends on project needs and budget. New cranes offer reliability, lower maintenance, and warranty coverage, making them ideal for long-term projects. Used cranes reduce upfront costs and are suitable for temporary or smaller-scale operations. Companies can access crane financing options or crane equipment financing regardless of the choice.

Heavy equipment crane loans often have better terms for new purchases, while construction crane financing for used cranes can be flexible with interest adjustments. Firms consider mobile crane finance, crane leasing programs, and crane hire purchase agreements to balance costs and operational efficiency. Comparing crane loan rates from multiple crane finance companies ensures the optimal financing structure is selected.

Eligibility Criteria for Crane Finance Approval

Approval for crane finance depends on financial stability, project plans, and credit history. Lenders review company accounts, repayment capability, and equipment purpose before offering crane financing options. Crane loan requirements typically include revenue thresholds, business age, and creditworthiness. Small businesses may inquire, can small companies get crane finance, to determine accessibility.

Additional considerations involve equipment finance for cranes and historical payment reliability. Firms must demonstrate operational capacity and financial responsibility. Options like industrial crane funding and crane capital financing may require collateral or guarantees. Meeting crane loan requirements ensures higher approval chances and better crane loan rates.

Documents Required for Crane Financing

Lenders demand comprehensive documentation before approving crane finance. Commonly requested items include financial statements, tax returns, business licenses, and credit reports. What documents are needed for crane finance often vary by lender, but proof of project contracts and equipment needs is standard. Companies applying for crane equipment financing must provide detailed project plans to support loan approval.

In addition, companies may submit insurance certificates, personal guarantees, or collateral documentation. Ensuring all crane loan requirements are met facilitates smooth application processes. Steps to apply for crane finance often include document verification, lender evaluation, and contract signing. Proper documentation ensures access to crane leasing programs, used crane financing, or new crane financing without delays.

Interest Rates and Typical Loan Terms for Crane Finance

Interest rates for crane finance depend on lender policies, company creditworthiness, and project scope. Interest rates for crane financing typically range from 6% to 12% for well-qualified businesses. Loan terms vary from 3 to 10 years, depending on the financing type. Crane loan rates for new crane financing may be lower due to lower maintenance risk, while used crane financing could carry slightly higher rates.

Flexible repayment schedules are common for construction crane financing and industrial crane funding. Some lenders provide seasonal payment options to accommodate cash flow. Crane capital financing and crane asset financing can be structured with early repayment options or balloon payments. Understanding how long are crane finance terms and potential rate changes ensures firms avoid surprises and maintain financial stability.

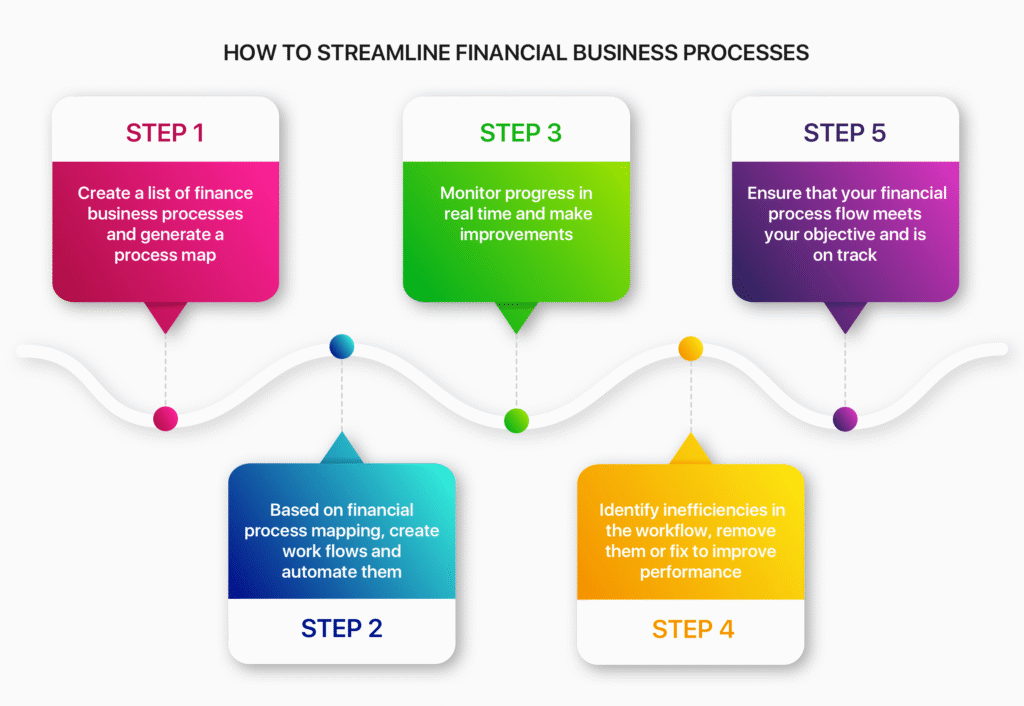

Step by Step Crane Finance Application Process

The application process for crane finance begins with assessing project needs and selecting a financing type. Companies must gather all documents and check eligibility criteria. Steps to apply for crane finance involve contacting lenders, submitting required materials, and negotiating terms. How to finance a crane includes reviewing crane loan vs crane lease options and comparing crane loan rates.

After submission, lenders review financials, verify business operations, and assess equipment value. Approval is followed by signing agreements for crane hire purchase, used crane financing, or new crane financing. Timely payment ensures smooth relationships with crane finance companies and may enable future refinancing or additional industrial crane funding.

Benefits and Risks of Crane Financing

Crane finance offers immediate equipment access without depleting cash reserves. Companies benefit from crane financing options, crane equipment financing, and flexible repayment schedules. Using mobile crane finance and crane leasing programs reduces upfront risk and allows operational scaling. Long-term ownership through heavy equipment crane loans provides asset control and potential tax advantages.

Risks include interest obligations and potential default. Poor planning can lead to higher costs, especially with crane loan rates or late payments. Understanding crane loan requirements and crane purchase financing implications mitigates risk. Companies must weigh operational benefits against financial exposure to maximize project efficiency.

How to Choose the Right Crane Finance Company

Selecting the right lender involves evaluating interest rates, repayment flexibility, and customer service. Who offers crane financing with transparent terms and supportive assistance is ideal. Comparing crane finance companies and reviewing crane leasing vs loan options ensures informed decisions. Firms should consider experience in industrial crane funding and reputation for reliability.

Check terms for used crane financing, new crane financing, and crane asset financing. A trustworthy company provides clear agreements and competitive crane loan rates. Ensuring all crane loan requirements are understood and met avoids surprises. The right company supports project success while optimizing financial outcomes.

Common Mistakes to Avoid When Financing a Crane

Many businesses make errors such as ignoring crane loan rates or failing to compare crane financing options. Skipping eligibility checks or neglecting crane equipment financing terms can lead to higher costs. Choosing between crane hire purchase and crane leasing programs without analysis may reduce benefits.

Other mistakes include underestimating operational needs or selecting lenders without verifying industrial crane funding history. Overlooking crane loan requirements or misunderstanding crane capital financing terms can cause delays. Careful planning ensures financing aligns with both project goals and financial capacity.

Real World Examples of Crane Financing Deals

Construction firms often combine crane finance and leasing strategies to complete large projects. For instance, a company might use mobile crane finance for temporary projects while relying on new crane financing for long-term investments. Used crane financing allows smaller businesses to expand fleets without exhausting cash flow.

The table below illustrates a financing scenario:

| Company Size | Financing Type | Loan Amount | Term | Payment |

| Small | Used crane financing | 120,000 | 5 years | 2,500 per month |

| Medium | New crane financing | 500,000 | 7 years | 7,000 per month |

| Large | Mobile crane finance | 1,200,000 | 10 years | 12,000 per month |

These examples highlight strategic use of crane leasing programs, construction crane financing, and crane asset financing to optimize operational efficiency.

FAQ’s

What is crane finance and who should use it

Crane finance is a structured funding method that helps businesses acquire cranes through loans, leases, or hire purchase instead of full upfront payment. It suits construction firms, contractors, and equipment rental companies that want to preserve cash flow while scaling operations.

How do lenders evaluate a crane finance application

Lenders review business revenue, project pipeline, credit profile, and asset value before approval. They also assess equipment age and resale strength to reduce risk and set suitable loan terms and pricing.

Is it better to lease or take a loan for crane finance

A loan works best when you plan long term ownership and heavy utilization. Leasing fits shorter project cycles and faster upgrades, since it lowers upfront cost and adds flexibility at contract end.

What documents are typically required for crane finance approval

Most applications require business registration papers, bank statements, tax returns, supplier invoice, and equipment details. Strong documentation speeds underwriting and improves approval odds with better rate offers.

How can crane finance improve business growth

Crane finance frees working capital and lets companies accept larger contracts without liquidity strain. Spreading payments over time stabilizes cash flow and supports steady fleet expansion and competitive bidding.

Conclusion

In conclusion, crane finance offers a practical solution for businesses looking to acquire expensive lifting equipment without straining their budgets. By exploring options like crane equipment financing and understanding how to finance a crane, companies can make informed decisions that optimize cash flow and operational efficiency. Whether opting for new or used cranes, loans or leasing programs, proper planning ensures projects stay on schedule while minimizing financial risk. Ultimately, crane finance empowers firms of all sizes to expand their capabilities, complete projects effectively, and remain competitive in the construction and industrial markets.

No responses yet