Understanding standard deduction 2025 is essential for every taxpayer aiming to minimize taxable income efficiently. This deduction allows you to reduce your earnings before federal taxes are calculated, making filing simpler and often more beneficial than itemizing. Many wonder how does standard deduction reduce taxable income or who qualifies for the standard deduction in 2025, and these questions highlight common concerns. By knowing the standard deduction 2025 rules, including eligibility and amounts based on filing status, you can optimize tax savings. Accurate knowledge ensures compliance while maximizing refunds and minimizing errors during tax season, making financial planning more effective and predictable.

What Is the Standard Deduction in the U.S. Tax System

The standard deduction 2025 is a fixed amount the government lets you subtract from income before taxes apply. This reduction lowers your taxable earnings automatically. Many taxpayers prefer it because it requires no expense tracking. When asking what is the standard deduction for 2025, think of it as a tax shield that protects part of your income from taxation.

The 2025 standard deduction IRS rules apply to most filers unless itemizing offers greater savings. For beginners, this system simplifies filing. The standard deduction explained for beginners usually highlights ease and reliability. It works under IRS standard deduction rules 2025, which ensure consistency. Many people also wonder if everyone will get the standard deduction in 2025, and the answer depends on eligibility rules explained later.

Standard Deduction Amounts for the 2025 Tax Year

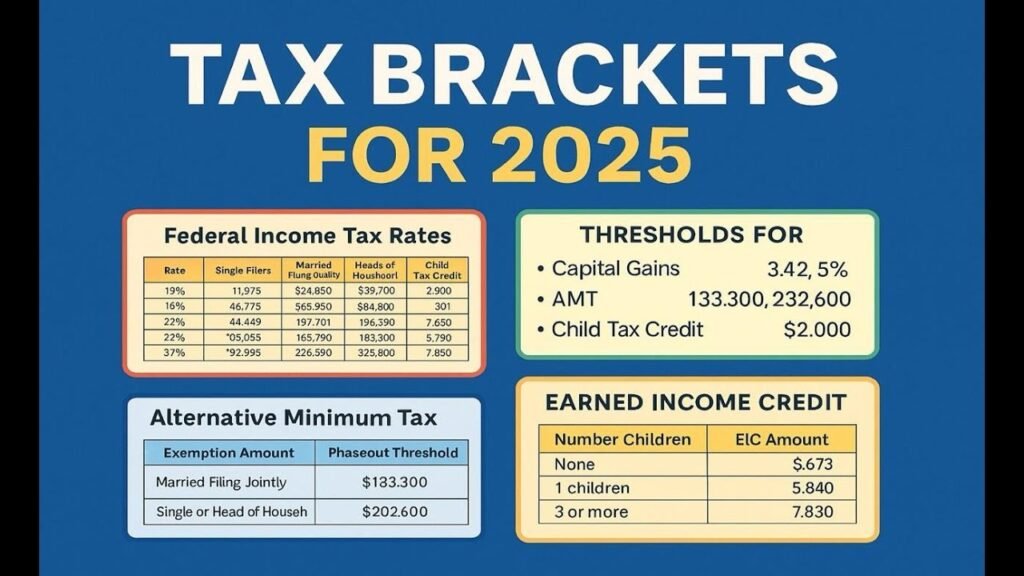

The standard deduction amount 2025 reflects inflation adjustments announced by tax authorities. These amounts rise slowly each year. When people ask how much is the standard deduction in 2025, the answer depends on filing status. The goal remains fair taxation as living costs increase nationwide.

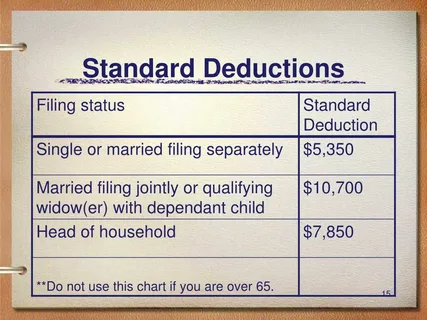

Below is a clear table showing the standard deduction changes 2025 for federal taxes.

| Filing Status | Deduction Amount |

| Single | $15,750 |

| Married Filing Jointly | $31,500 |

| Head of Household | $23,625 |

This table helps explain standard deduction by filing status 2025. The standard deduction inflation adjustment 2025 protects taxpayers from hidden tax increases. These figures shape standard deduction tax savings 2025 for millions.

Standard Deduction by Filing Status in 2025

Your filing status decides how much deduction you receive. The standard deduction for single filers 2025 applies to unmarried taxpayers. Married couples benefit from the standard deduction married filing jointly 2025, which doubles the single amount. Families often use the head of household standard deduction 2025 for higher relief.

Many taxpayers ask what filing status gives highest standard deduction, and married filing jointly usually wins. The IRS applies strict standard deduction filing status rules. Choosing incorrectly can reduce savings. First time filers often search standard deduction for first time filers to avoid errors. Filing status affects fairness and accuracy in the tax system.

How Inflation Adjustments Affect the Standard Deduction

Inflation quietly reduces buying power each year. The IRS counters this by adjusting deductions. The standard deduction inflation adjustment 2025 increases deduction amounts slightly. This ensures taxes reflect real economic conditions rather than outdated values.

When people ask if the standard deduction will increase in 2025, inflation is the reason. These adjustments prevent income from creeping into higher taxes unfairly. Over time, this protects taxable income after standard deduction 2025 from rising too fast. Inflation indexing keeps the tax code balanced and predictable for households.

Additional Standard Deduction for Seniors in 2025

Older taxpayers receive extra benefits. The additional standard deduction 2025 applies when age reaches sixty five. Many wonder if seniors get higher standard deduction, and the answer is yes. This helps retirees manage fixed incomes.

The standard deduction for seniors 2025 reflects healthcare costs and limited earnings. People often ask for an extra standard deduction for age 65 in 2025, which adds a fixed amount on top of the base deduction. These rules reward long working lives and support financial stability in retirement.

Extra Standard Deduction for Blind Taxpayers

Blind taxpayers receive an extra allowance. This rule recognizes added daily expenses. The IRS treats blindness similarly to age benefits. This support ensures fairness in taxation.

This extra amount combines with the base standard deduction 2025. It helps reduce taxable income after standard deduction 2025 even further. These protections reflect inclusive tax policy. The system ensures vulnerable groups receive meaningful relief under federal law.

Who Is Eligible to Claim the Standard Deduction

Eligibility rules matter. Many ask who qualifies for the standard deduction in 2025, and most taxpayers qualify. However, some exceptions exist. Nonresident aliens and certain trusts cannot claim it.

Eligibility depends on filing status and dependency. People also ask if standard deduction is automatic in 2025, and yes, it applies unless itemizing is chosen. Understanding eligibility prevents filing delays. Clear knowledge ensures compliance with IRS standard deduction rules 2025.

Standard Deduction Rules for Dependents

Dependents follow special rules. The standard deduction for dependents 2025 is limited. Many parents ask can dependents claim standard deduction in 2025, and the answer depends on income type.

Below is a simple table showing standard deduction limits for dependents.

| Earned Income | Deduction Rule |

| Low income | Minimum amount |

| Higher income | Earned income plus allowance |

These limits prevent misuse while offering basic relief. Parents should understand dependent rules clearly.

Standard Deduction vs Itemized Deductions in 2025

Choosing between the standard deduction 2025 and itemized deductions is a decision that can significantly affect your tax liability. Many taxpayers wonder if I should take standard or itemized deductions in 2025, especially if they have significant medical expenses, mortgage interest, or charitable donations. The standard deduction vs itemized deduction 2025 comparison highlights simplicity versus potential savings. While itemizing requires thorough documentation and receipts, the standard deduction provides a fixed, reliable reduction to taxable income, eliminating the need for tracking numerous expenses throughout the year. Understanding which method benefits your unique financial situation can save time and maximize refunds.

The standard deduction 2025 is particularly helpful for those with straightforward finances, such as single filers or retirees. People often ask standard deduction vs itemized which is better, and simplicity frequently outweighs minor extra savings from itemizing. Choosing the right method ensures compliance with IRS standard deduction rules 2025 and prevents common filing mistakes. Planning ahead and reviewing expenses annually allows you to decide whether itemizing surpasses the standard deduction, which is why careful comparison is critical for optimizing standard deduction tax savings 2025.

How the Standard Deduction Reduces Taxable Income

The standard deduction 2025 reduces taxable income directly by subtracting a fixed amount from gross earnings. Many taxpayers ask how does standard deduction reduce taxable income, and the answer is simple subtraction. For example, if your income is $50,000 and your standard deduction amount 2025 is $15,750 for a single filer, the remaining $34,250 becomes your taxable income. This mechanism lowers the total taxes owed and can increase the refund you receive when filing, making it one of the most efficient ways to reduce tax liability without extra paperwork or tracking expenses.

This deduction is particularly beneficial because it automatically adjusts for inflation through the standard deduction inflation adjustment 2025, ensuring your deductions keep pace with rising living costs. By lowering taxable income, it also simplifies calculations for those using electronic filing systems. Taxpayers who are new to filing often ask for a standard deduction explained for beginners, and this straightforward subtraction demonstrates why millions rely on the standard method instead of itemizing. Understanding this impact helps optimize your overall taxable income after standard deduction 2025 and improves financial planning.

Real Examples of Standard Deduction Calculations

A practical standard deduction example 2025 helps illustrate its effect on taxes. Imagine a single taxpayer earning $60,000 annually. The standard deduction for single filers 2025 is $15,750. Subtracting this deduction leaves $44,250 in taxable income. Taxes are calculated only on this amount rather than the full income, showing how the standard deduction directly reduces your taxable earnings and increases potential refunds.

In another scenario, a married couple filing jointly with $100,000 in income uses the standard deduction married filing jointly 2025 of $31,500. Their taxable income drops to $68,500, simplifying the filing process and avoiding the complex tracking needed for itemized deductions. Examples like these demonstrate how choosing the standard deduction 2025 often produces immediate and tangible benefits. Observing such cases clarifies why many taxpayers, including dependents or seniors, rely on the standard method to maximize standard deduction tax savings 2025.

Common Mistakes Taxpayers Make with the Standard Deduction

Errors in claiming the standard deduction 2025 are more common than many realize. Common mistakes include selecting the wrong filing status, misreporting dependent eligibility, or failing to account for additional deductions. Taxpayers often wonder about standard deduction filing mistakes and how they can prevent them. Misapplication can delay refunds, trigger IRS notices, or lead to overpayment. Reviewing IRS standard deduction rules 2025 ensures deductions are claimed correctly and helps avoid costly errors.

Another frequent issue is misunderstanding age or blindness allowances. The additional standard deduction 2025 or extra standard deduction for age 65 in 2025 may be overlooked, reducing potential savings. Parents and guardians may miscalculate the standard deduction for dependents 2025, creating discrepancies. Careful preparation, double-checking filing forms, and staying informed about annual standard deduction changes 2025 are essential for accurate submissions. These small preventive steps safeguard refunds and streamline the tax process for both first-time filers and seasoned taxpayers.

How to Claim the Standard Deduction on Your 2025 Tax Return

Claiming the standard deduction 2025 is straightforward when filing electronically. Most tax software automatically applies the correct deduction based on your standard deduction by filing status 2025, including adjustments for seniors or dependents. Taxpayers often ask where to enter standard deduction on tax return, and the forms provide clear fields for this purpose, ensuring the reduction is accurately reflected in taxable income.

To successfully claim standard deduction 2025, select the standard option rather than itemizing. Electronic filing ensures compliance with IRS standard deduction rules 2025 and reduces the risk of mistakes. Following proper filing procedures maximizes standard deduction tax savings 2025, lowers tax owed, and streamlines refunds. Even for complex situations, such as first-time filers or households with dependents, the standard deduction simplifies calculations while maintaining compliance with federal regulations.

Federal Standard Deduction vs State Standard Deductions

The federal standard deduction 2025 applies uniformly across the U.S., but state rules can differ widely. Some states adopt the federal amount, while others provide separate deductions or require itemization. Taxpayers often ask if everyone gets the standard deduction in 2025 at the state level, and the answer varies depending on local law. Understanding both federal and state systems is crucial for accurate filing.

State-level rules may restrict deductions, limit benefits for dependents, or cap allowances for seniors. Comparing federal standard deduction 2025 with local standards helps taxpayers determine optimal filing strategies. Awareness of these differences ensures that deductions are maximized without errors, reduces audit risk, and helps taxpayers plan for both standard deduction tax savings 2025 and any additional state-specific benefits. Keeping informed protects refunds and simplifies overall tax management.

FAQ’s

What is the standard deduction for 2025?

The standard deduction 2025 is a fixed amount taxpayers can subtract from their income to reduce taxable earnings. It varies by filing status and simplifies tax filing compared to itemizing deductions, providing predictable tax savings.

Who qualifies for the standard deduction in 2025?

Most U.S. taxpayers qualify for the standard deduction 2025, including single filers, married couples, and heads of household. Exceptions apply to nonresident aliens, certain estates, and those required to itemize due to high deductible expenses.

How much is the standard deduction in 2025?

The standard deduction amount 2025 depends on filing status: single filers receive $15,750, married filing jointly get $31,500, and heads of household claim $23,625. Seniors and the blind may receive additional amounts.

Should I take standard or itemized deduction in 2025?

Choosing between standard deduction vs itemized deduction 2025 depends on expenses. Taxpayers with high deductible costs like mortgage interest or medical expenses may benefit from itemizing, while most find the standard deduction simpler and more advantageous.

How does the standard deduction reduce taxable income?

The standard deduction 2025 directly subtracts from gross income, lowering taxable income after standard deduction 2025. This reduction decreases federal tax liability and can increase refunds, making it a fundamental tool for efficient tax planning.

Conclusion

In conclusion, understanding standard deduction 2025 empowers taxpayers to make informed decisions and maximize savings while reducing taxable income. Knowing standard deduction by filing status 2025 and standard deduction for seniors 2025 ensures compliance with IRS rules and prevents common errors. Proper use of the standard deduction 2025 simplifies filing and often results in higher refunds compared to itemizing. Staying aware of eligibility, additional deductions, and recent changes allows you to plan effectively and avoid surprises during tax season. Mastering these details not only enhances financial efficiency but also provides peace of mind, making the tax process less stressful and more predictable.

No responses yet